In 2024, the only thing growing faster than AI models was our collective burnout.

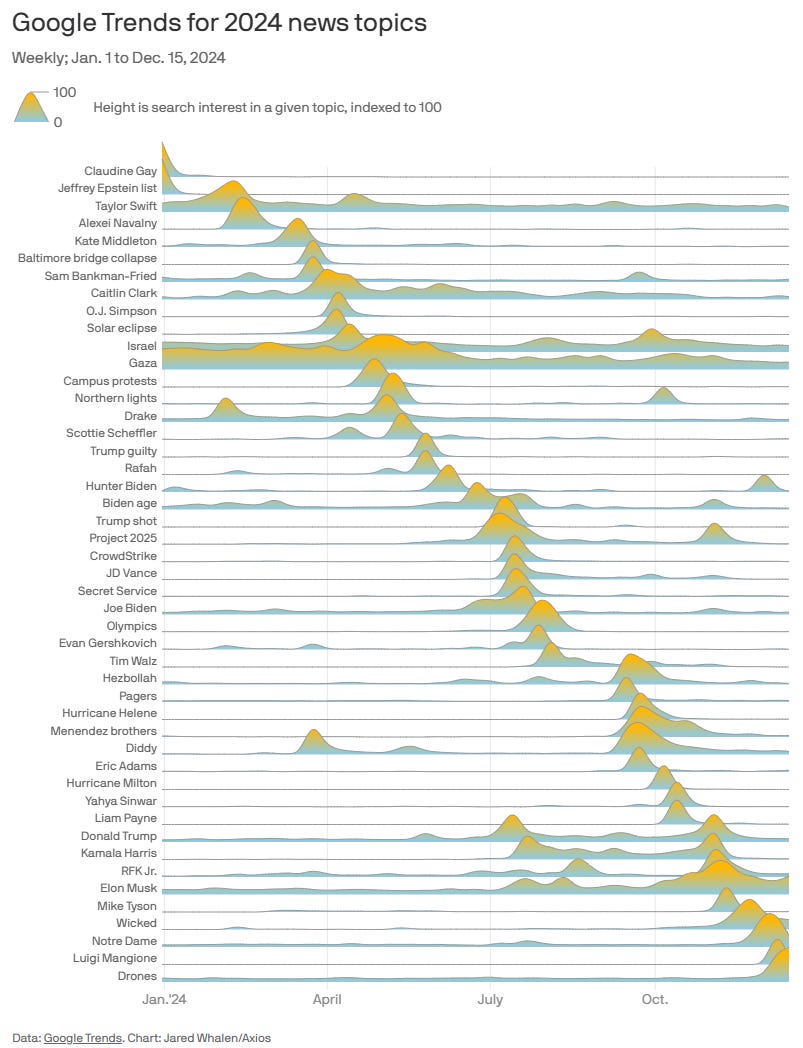

2024 was a whirlwind of political chaos, the Paris Olympics, and headline-grabbing drama. Even in a heated election year, America’s attention span stayed as short as ever, bouncing from one major story to the next.

Zoom out: how did this all materialize in markets and the economy? As the old saying goes, markets climb a wall of worry.

A FEW THOUGHTS ON PUBLIC MARKETS

It was an exceptional year for risk assets, plain and simple.

The S&P 500 rose 23% and the Nasdaq did even better at 29%. Once again, the Magnificent 7 (NVDA 0.00%↑ AAPL 0.00%↑ MSFT 0.00%↑ AMZN 0.00%↑ GOOG 0.00%↑ TSLA 0.00%↑ META 0.00%↑ ) lead the way for QQQ (and the S&P):

The S&P is up a massive 68% since it bottomed in late 2022—good for its first back-to-back 20%+ annual returns since the late 90s. Let that sink in.

Some perspective:

Falling inflation, robust GDP growth, and rising corporate profits fueled broad market gains.

Crypto is catching a bid as DC seems to be warming up to the industry. Looking back, markets got their wish: lower rates, cooling inflation, and a resilient economy. Few investors foresaw this Goldilocks scenario, but here we are.

Did we just pull off the mythical soft landing?

Thanks, Jay Powell!

PRIVATE MARKETS

Last year, I wrote:

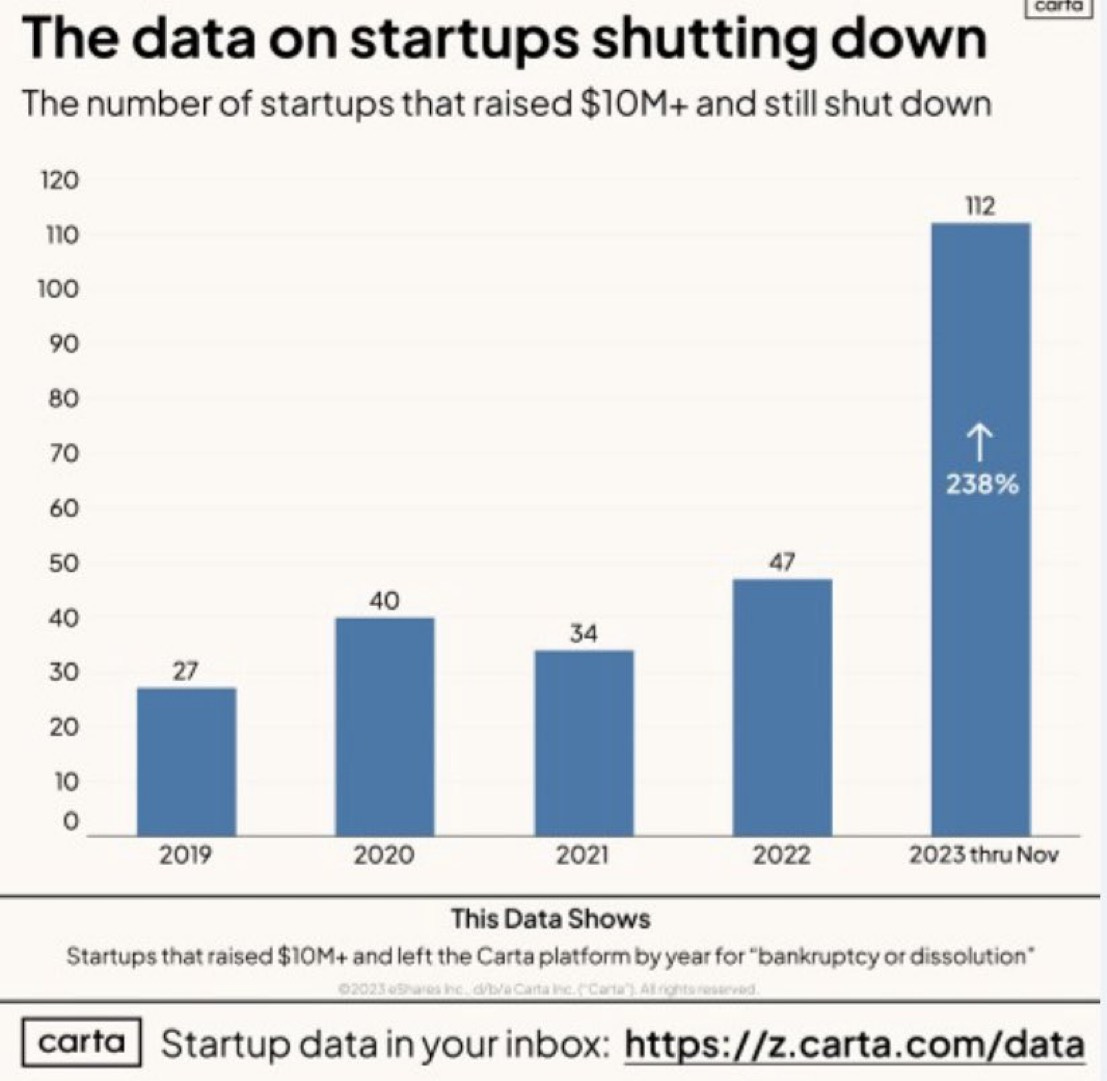

Raising money hasn’t been easy; many teams are battling limited runway.

I’m not sure 2024 will be any less challenging, as all signs point to more pain in startup land. We will likely see more recapitalizations and down-rounds. Startups with inefficient business models and a lack of investor support will fold or be sold for pennies on the dollar.

The best companies will be okay—though it may take years for them to grow back into their valuations.

First, let’s start with the bad news.

Per Carta, over 20% of all new venture investments in Q3 were down rounds, marking the fourth-highest quarterly total since at least early 2019. Startups continue to grapple with the widespread valuation reset that began in mid-2022.

From Carta:

During that boom, from Q4 2020 through Q2 2022, startups raised more than $30 billion and completed more than 1,600 transactions for seven consecutive quarters. But it’s clear this was an outlier, not a new normal. In the other 20 quarters dating back to the start of 2018, quarterly capital raised has never finished above $23.8 billion, and deal count has topped 1,500 only once.

Now, some good news.

The Series B market finally showed signs of life in Q3, crossing $5B in quarterly fundraising for the first time in over a year. Deal volume jumped 10% from Q2 - the first meaningful uptick in five quarters.

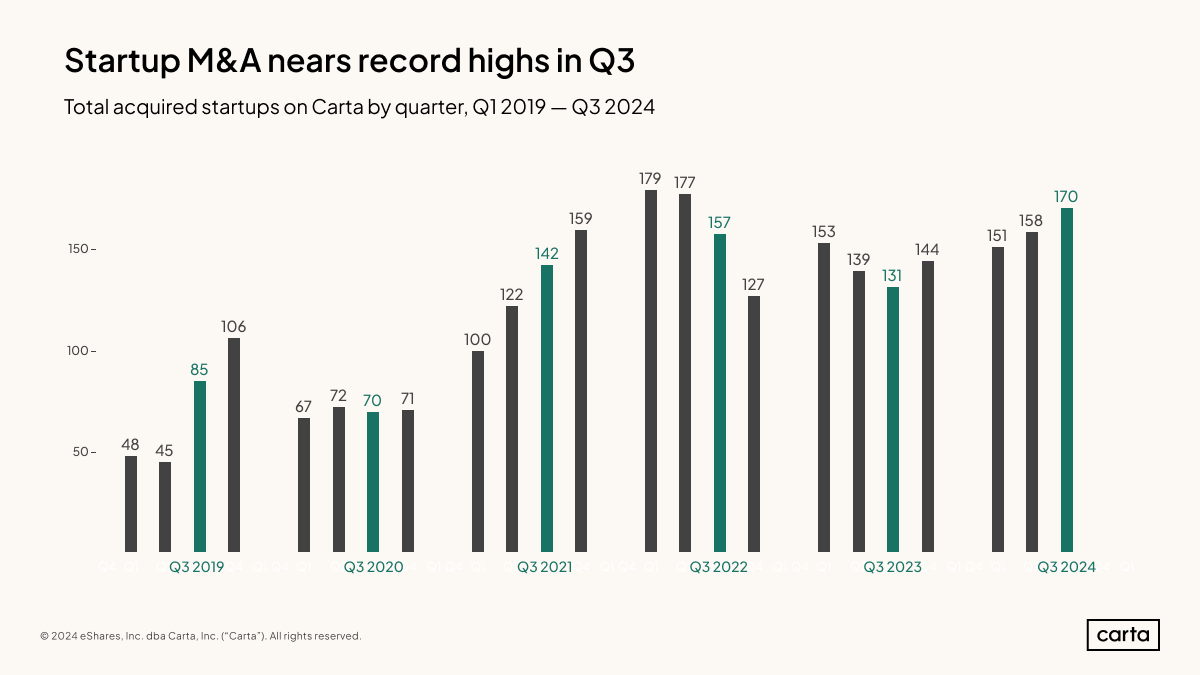

M&A activity is increasing: Startups on Carta were the target of 170 M&A transactions during Q3, the highest quarterly figure since mid-2022. Total M&A activity targeting startups has now increased in four straight quarters.

At the same time, with private markets swimming in cash, the best (tech/SaaS) companies can keep dodging IPOs. The public markets drought might stick around.

On that note, this quote from Howard Lindzon was too good not to share:

From 2009-2021 ZIRP, the iPhone, the cloud, the social mobile web and venture funded customer acquisition costs brought us a sea of ‘unicorns’ real and false. I think Fartcoin becoming a unicorn in 2024 puts a stamp on how silly that whole era was. A unicorn means nothing in the era that a Fartcoin market cap equals $1 billion.

At the time of writing, Fartcoin is up 2,631,763.92% all-time with a market cap of $1.31 billion. What a time to be alive!

Revisiting My 2024 Predictions

See here for original post.

S&P 500 up ~5%.

Swing and a miss. I got the “up” part right but was off by about 20%. Markets have a funny way of humbling us all.

The IPO market comes back and Stripe has a successful IPO.

Directionally correct, but I got this one wrong. Slowly but surely, IPOs continue to make a comeback, however, only nine venture-backed companies went public above a billion dollars in 2024 and Stripe wasn’t one of them.

SGA for MVP.

Wrong again (lol). In my defense, SGA finished second and is atop the NBA MVP rankings as the calendar flips from 2024 to 2025.

2025 Predictions

Deal flow: from frozen to flowing? Following the boom in 2021, overall M&A activity hit its lowest level since 2013. But the thaw might finally be here. Rates are heading down, the regulatory picture is clearing up, and a massive backlog of deals is ready to go. Private credit is stepping up to grease the wheels.

When dealmaking picks up, who wins? The usual suspects: Wall Street banks, PE and credit shops, and private business owners looking to sell. Keep an eye on Big Tech, which might put its massive cash hoards to work.

AI spending continues to ramp, with “agents” emerging as the hottest buzzword in the space. Building on 2024’s momentum, rapid advancements and plummeting costs have cemented AI’s place as a transformative force. LLMs now solve 90%+ of advanced math problems, up from just 10% in 2021, and corporate adoption still has significant runway.

The next major unlock? Frontier models with enhanced inference and contextual reasoning capabilities. Yes, hurdles like regulation and energy sourcing exist, but the bull case for AI is alive and well. Like cloud and mobile before it, AI is shaping up to drive the next era of growth and innovation.

Bitcoin hits $250k. Animal spirits are in full effect, Silicon Valley power players and technology accelerationists infiltrated the White House, DC is quickly becoming crypto-friendly, and the degenerate economy is raging ahead — the stars might be aligning.

Stuff Worth Your Time

Sharing a handful of recent articles and podcasts that I found insightful:

What Happened In 2024 by Fred Wilson (Union Square Ventures)

The Gen AI Bridge to the Future by Stratechery

BG2 w/ Bill Gurley & Brad Gerstner. See here for my notes

Invest Like the Best

Inside the Coming AI Market “Supercycle” and How Cloud Startups Can Benefit by Battery Ventures

2024 Market Update by Meritech Capital

Happy New Year!

Wishing you joy, peace, and prosperity.

Let’s go crazy (aka keep pushing to be the best versions of ourselves).