Commerce at the Limit, Meta's AI Avengers, and Positioning for Dollar Debasement

Issue #6 | Margin of Signal: July 13, 2025

A weekly curation of the highest-signal content across investing, business, tech, and AI.

This week, we explore:

The future of commerce & digital advertising

Meta’s AI Avengers

Dollar debasement (and what that means for markets)

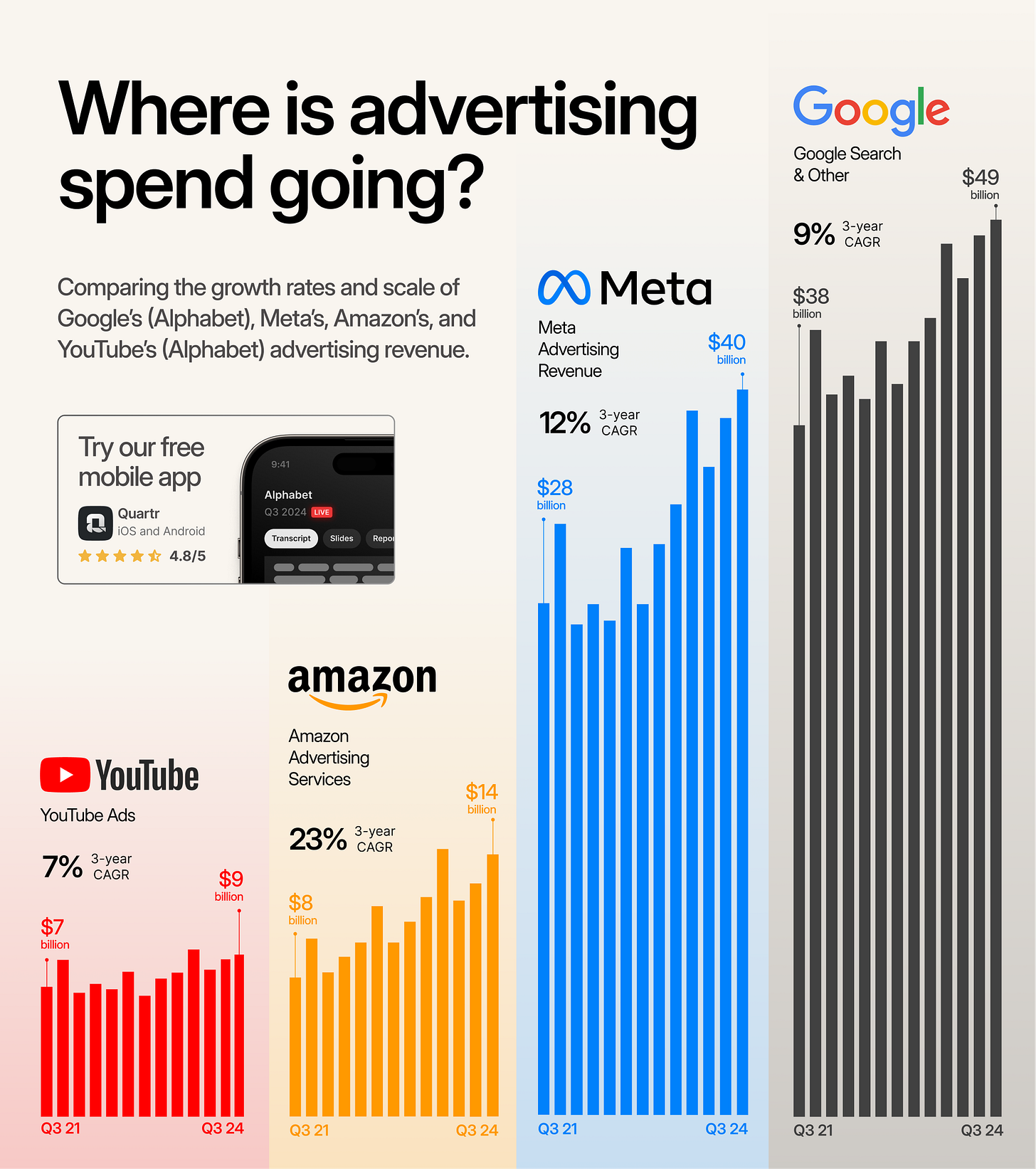

The new golden age of digital advertising (and beyond)

In his recent podcast episode, “Commerce at the limit,” digital ads expert Eric Seufert argues that we’ve entered the most exciting and disruptive period in the modern history of digital advertising.

But this era isn't about more granular control for advertisers.

It's about the opposite.

It's an era defined by the sweeping automation of advertising by AI, a trend that’s culminating in profoundly powerful "black box" systems like Meta's Advantage+ and Google's Performance Max.

Key Insight #1: This shift consolidates power within black box platforms like Meta's Advantage+, which intentionally obscure operational details from advertisers in exchange for superior performance.

Seufert posits:

It’s obvious why the black box totally automated ad paradigm is beneficial to platform owners. It virtually guarantees maximized profits as the platform strives to deliver minimally to a goal... Maybe it could have targeted users better, or maybe not, but the advertiser will never know. Facebook owns that insight.

He traces the decade-long evolution of this trend, from Google's initial Universal App Campaigns (UAC) in 2017 to Meta's more recent Advantage+ suite. The trajectory is clear: platforms are systematically dismantling advertisers' ability to manually control targeting, bidding, and creative placement.

In exchange for this loss of control, they offer access to vastly superior optimization capabilities.

These systems absorb high-level business goals and then execute autonomously, using their immense datasets to achieve results that most advertisers couldn’t replicate on their own. This is a lifeline for small businesses, giving them access to enterprise-grade marketing tools and leveling the operational playing field.

Of course, the fuel accelerating this fire is generative AI.

The democratization of high-quality video and image production through tools like Veo 3 and Midjourney removes one of the last key advantages held by large incumbents: massive creative budgets. When any business can generate a vast and diverse portfolio of ad creative at near-zero cost, the platforms' AI has more to work with, making the automated system even more potent.

Key Insight #2: With ad execution becoming a commodity, the new frontier for competitive advantage lies in a fusion of product marketing and high-frequency experimentation.

Eric notes (quote edited for clarity):

And if things like product landing pages and onboarding processes are where incremental value can be found, compounded by more effective advertising, then it’s where talent and resources will accumulate. This emerging function, a mix of growth marketing, product marketing and high frequency experimentation, is where the firms that benefit most from AI enablement and advertising will focus their attention. This is innovative churn, the essence of Shupter’s creative destruction, and I believe this function and the new roles that support it will accelerate commerce at the limit.

As AI commoditizes the execution of advertising, Seufert argues that human talent and resources will pivot to a new, emerging function: a hybrid of growth marketing, product marketing, and high-frequency experimentation.

When the ad platform can handle the "how," the critical role for humans becomes the "what"—personalizing the product itself, optimizing landing pages, and running experiments to find the perfect synergy between product and market.

This "innovative churn" is the new locus of competitive advantage and the engine that will accelerate the journey toward commerce at the limit: a future where the path from consumer intent to commercial transaction is near-instantaneous, fully automated, and extraordinarily efficient.

Meta’s AI Avengers

Relatedly, Mark Zuckerberg is assembling a team of top AI researchers and engineers, dubbed the "AI Avengers," to build superintelligence at Meta.

This team is focused on developing advanced AI capabilities, including multimodal AI (image, video, and speech generation), and is poaching top talent from rivals like OpenAI and Google.

As an example, Jiahui Yu led OpenAI’s Perception team, spearheading projects like the “Thinking with Images” system and guiding the development of key models, including o3, o4‑mini, GPT‑4.1, and advising on image‑generation capabilities.

The AI superstar also co-led Gemini's multimodal efforts when he worked at Google.

In recent weeks, OpenAI freed up salary cap space by sending Yu to Meta for a reported $100 million compensation package.

Half-joking, but this is an incredible moment of tech lore to witness.

Recent reports claim the typical Meta offer is $200 million over 4 years. That’s ~100x their peers.

There have also been some BILLION dollar offers that weren’t accepted by research & engineering leadership at OpenAI and Mira Murati’s Thinking Machines Lab.

This week, Zuck stole one more AI leader from the competition.

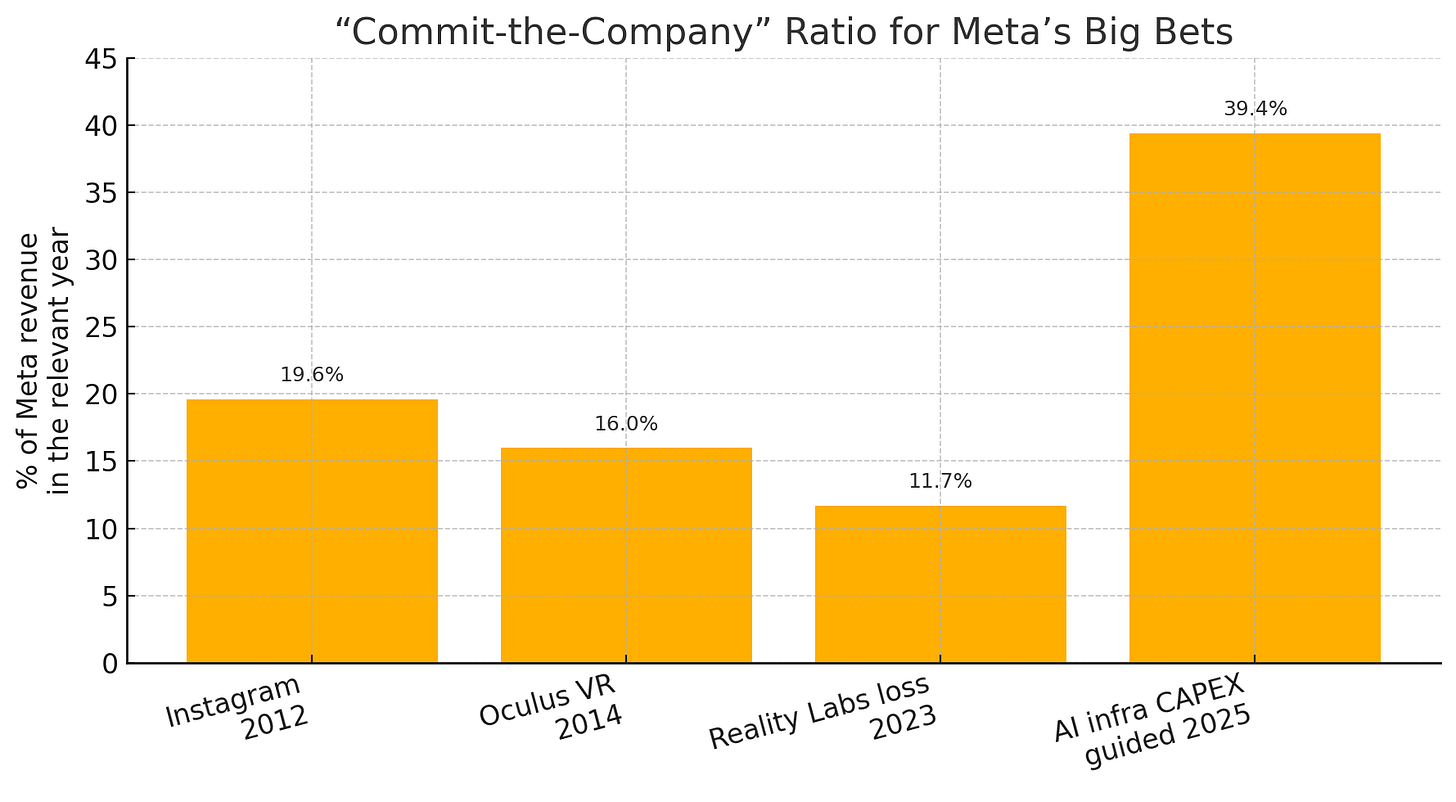

At this point, Meta’s talent shopping spree is firmly in the tens of billions of dollars. All in just the last month.

Some context:

I think it’s helpful to zoom out and think about why they’re blowing all this money.

Truly top AI talent is a rare resource that’s in high demand. The people who are building and scaling premier AI models are suddenly being paid more than professional athletes, and it makes sense:

The potential financial upside from “winning” in AI is enormous

Outputs are somewhat measurable

The work-to-be-done is the same across the various companies bidding for talent

Ben Thompson explained it well (quote edited for clarity):

It’s that last point (the work-to-be-done is the same across the companies bidding for talent) that’s fairly unique in tech history. While great programmers have always been in high demand, and there have been periods of intense competition in specific product spaces, over the past few decades tech companies have been franchises, wherein their market niches have been fairly differentiated: Google and search, Amazon and e-commerce, Meta and social media, Microsoft and business applications, Apple and devices, etc. This reality meant that the company mattered more than any one person, putting a cap on individual contributor salaries.

AI, at least to this point, is different: in the long run it seems likely that there will be dominant product companies in various niches, but as long as the game is foundational models, then everyone is in fact playing the same game, which elevates the bargaining power of the best players. It follows, then, that the team they play for is the team that pays the most, through some combination of money and mission; by extension, the teams that are destined to lose are the ones who can’t or won’t offer enough of either.

Meta’s ad-powered AI engine

It remains to be seen what exactly Zuck and the Superintelligence crew are building, but I think it’s safe to assume printing handsome profits via digital ads is the endgame.

Meta’s ad ecosystem isn’t just a cash cow. It’s the ultimate R&D playground.

It’s a live, global‑scale crucible where every impression, click, and conversion feeds a self‑improving AI loop.

Beyond boosting ad performance, the AI Avengers are architecting a commercial superintelligence that refines itself with each dollar spent.

Despite Apple's ATT rollout and growing privacy constraints, Meta has quietly rebuilt its measurement stack. Tools like Advantage+, Conversion API, and Value Optimization now deliver 2–2.5× ROAS lifts in brand audits.

Advertisers give up control, but get better results. That’s the trade.

As Seufert puts it in Commerce at the Limit, this is the future: black-box AI systems optimizing to outcomes, not inputs. You define the goal, Meta handles the execution.

And it's working (all metrics from Meta’s Q1 2025 earnings report):

3.43 billion Family Daily Active People (March 2025 avg; +6% YoY)

$42.31 billion revenue (+16% YoY)

$16.64 billion net income (+35% YoY)

41% operating margin (vs 38% in Q1 2024)

5% YoY increase in ad impressions

10% YoY increase in average price per ad

~1 billion monthly active Meta AI users

2–2.5× ROAS lifts on Advantage+ / Conversion API campaigns (third‑party audits)

No material drop in ad performance post‑ATT, with ad growth in line with overall revenue gains

Again, Meta is building a real-time, self-reinforcing AI engine.

It’s a superintelligence that feeds itself with every impression, click, and conversion.

That engine is the bridge to commerce at the limit.

Where AI shortens the distance between desire and transaction.

Where the funnel disappears.

Where Meta wins by default.

What are the odds that Meta becomes the most valuable company in the world within the next 5–10 years?

The more I think about it, the more inevitable it seems.

We’re already living in the attention economy. And all signs point to deeper entrenchment, not less.

I don’t think I own enough Meta stock.

From deflation to debasement: a market shift

Warren Pies (co-founder of 3Fourteen Research) is one of the best in the biz when it comes to explaining complex macroeconomic topics in layman’s terms.

In this interview, Pies discusses a significant long-term market shift from a "debt deflation mindset" to a "currency debasement mindset."

Other topics include:

Residential real estate

Why he’s bullish equities

Fed & bond market dynamics

The Mindset Shift:

Debt deflation mindset (2008-COVID): Characterized by concerns over nominal loss and principal protection, stemming from private sector debt buildup and defaults (e.g., GFC). There was reticence about fiscal spending.

Currency debasement mindset (post-COVID): Characterized by concerns about losing purchasing power and assets not keeping up with appreciation. This manifests in real-world aspects like housing and car affordability, and encourages speculation (e.g., crypto, gambling to hit a home run rather than 9-5 jobs). Retail investors have been conditioned to buy dips.

Market Implications of the Debasement Mindset:

Risk origin: Risks are more likely to emanate from the bond market or government fiscal situation, rather than an '08-style economic recession.

Portfolio strategy: The traditional negative stock-bond correlation (magic of 60/40 portfolio) is less reliable. Investors need capacity for more real assets such as gold, Bitcoin, energy (as an alternative investment), and managed futures.

Bond market: Pies argues the bond market has not been significantly "spooked" by fiscal policy. Foreigners, particularly in Asia and Europe, have been net buyers of short-term US treasuries. While long-term trends may be unsustainable, an imminent crisis in the bond market is not foreseen. Fair value for the 10-year Treasury is around 4.4% based on market expectations of Fed cuts. Bond market moves are primarily driven by incoming data (e.g., weak growth/labor data would lead to more cuts and lower yields).

Economic outlook: No recession is currently modeled. A potential recession would likely start in rate-sensitive areas, specifically housing, due to its multiplier effect. However, key leading indicators like residential construction payrolls don’t yet show the necessary layoffs, partly due to labor hoarding by homebuilders with strong margins and low stress. This suggests a "growth scare" rather than a full recession.

Equity Market Outlook:

Bullish stance: Overweight equities, as no recession or Fed is tightening on the horizon. Equities generally benefit from a debasement mindset.

AI as a catalyst: AI is seen as a powerful upside story, with adoption rates ramping up and an S-curve ramp in token generation expected to quadruple by next year. This should drive productivity gains and margin expansion, especially in large-cap S&P 500 companies, leading to multiple expansion.

Market breadth: Acknowledged as a concern (mega-caps leading, median stock lagging), but is seen as a recurring pattern since 2023. The expectation is for a broadening out of the market as AI benefits spread, with confirmation needed from the S&P Equal Weight Index within three months of S&P 500 new highs.

Fundamentals & sentiment: Forward S&P 500 earnings are at an all-time high, which is historically positive for performance. Sentiment has reset, with strategists' targets now below the spot S&P 500, which is a bullish signal.

Seasonality: Volatility in the first half of a first-year presidency is normal, followed by a rally. July seasonality, especially the first half, is typically very positive for markets, even stronger after a strong May and June.

Key Predictions (year-end targets):

S&P 500: 6800

Fed cuts: 3 cuts by year-end (revised from 100bps to 75bps due to the Fed's "recalcitrant" stance post-tariff announcements). First cut could come in September.

10-Year Treasury: Trends lower, averaging around 4.1% in H2.

Oil: Breaks below $60 (already happened), with more downside expected.

Gold: Target raised to $3500, as all roads lead to gold in a debasement world.

That’s it for this week. We’ll be back in your inbox next Sunday with another Margin of Signal.

Thanks for reading,

Chima