The Price of Attention, Figma IPO, and Why the Stock Market Always Wins

Issue #5 | Margin of Signal: July 6, 2025

A weekly curation of the highest-signal content across investing, business, tech, and AI.

This week, we explore:

The price of attention (and what that means for investors & operators)

Figma’s upcoming IPO

AI winners and market dynamics

Why the stock market always wins

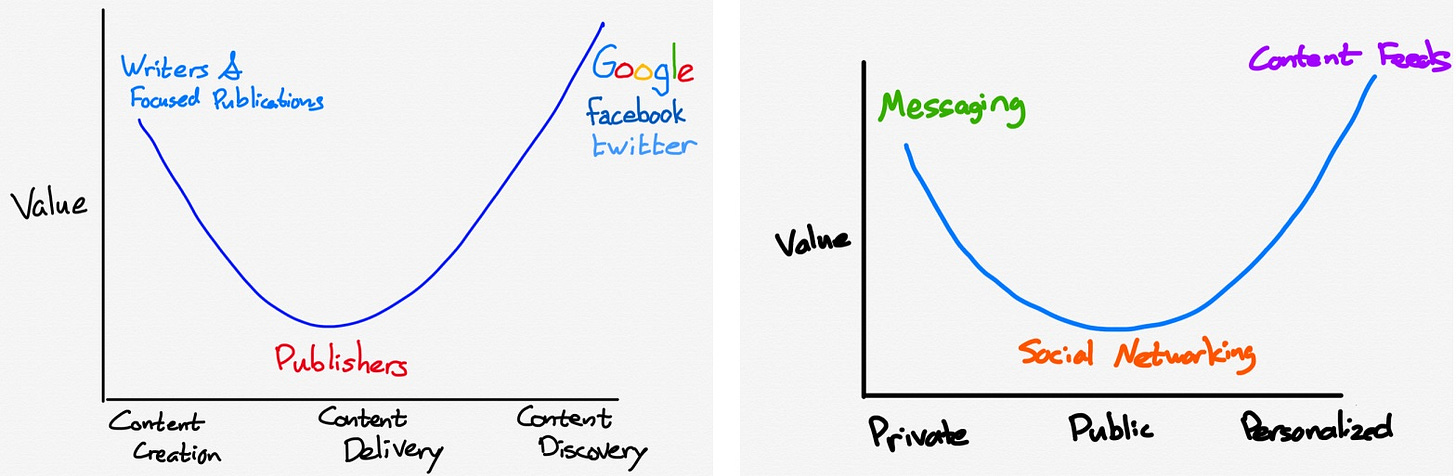

The Attention Economy: yesterday’s price is not today’s price

In The Price of Attention, John Candeto opens with a stark reminder: in today's world, attention is the one thing every seller of goods, services, or ideas must secure in ample supply or face extinction.

With roughly eight billion people alive, there are exactly eight billion minutes of attention happening right now, and no more to be had.

Human attention is the one truly finite resource in the digital economy. Everything else can be scaled, copied, or improved; attention cannot.

A rising tide that lifts the giants

What's especially striking is how the "price" of attention has been climbing (and accelerating) with every new platform and format.

The dramatic shift to digital-native advertising suggests attention is increasingly being priced by digital advertisers.

So, is the price of attention going up?

Search still comprises the majority of digital advertising, so one way we could answer this question is to ask if the value per point of search market share has gone up?

The value per point of search market share has roughly tripled over the past five years, while Meta's price per user has doubled in the same period.

Yet global ad spend as a share of GDP has edged down—proof that digital platforms aren’t just grabbing eyeballs, they’re turning them into gold with unprecedented efficiency.

Those firms already commanding massive audiences enjoy a dual benefit: higher valuations today and a durable economic moat tomorrow.

Why this matters for investors & builders

Perhaps most notable (and counterintuitive) is that this isn't merely a media story but a foundational economic shift. As the cost of creating "noise" approaches zero thanks to AI and digital tools, the value of genuine curation and enduring content will skyrocket.

For investors, that means looking beyond traditional metrics to where eyes and mindshare are truly aggregating.

Businesses that can organically draw and sustain focus will see their intrinsic value compound over time, while the mathematical reality of attention scarcity creates an ever-widening moat around attention monopolists.

Attention is the ultimate currency, and its mint is more exclusive than ever.

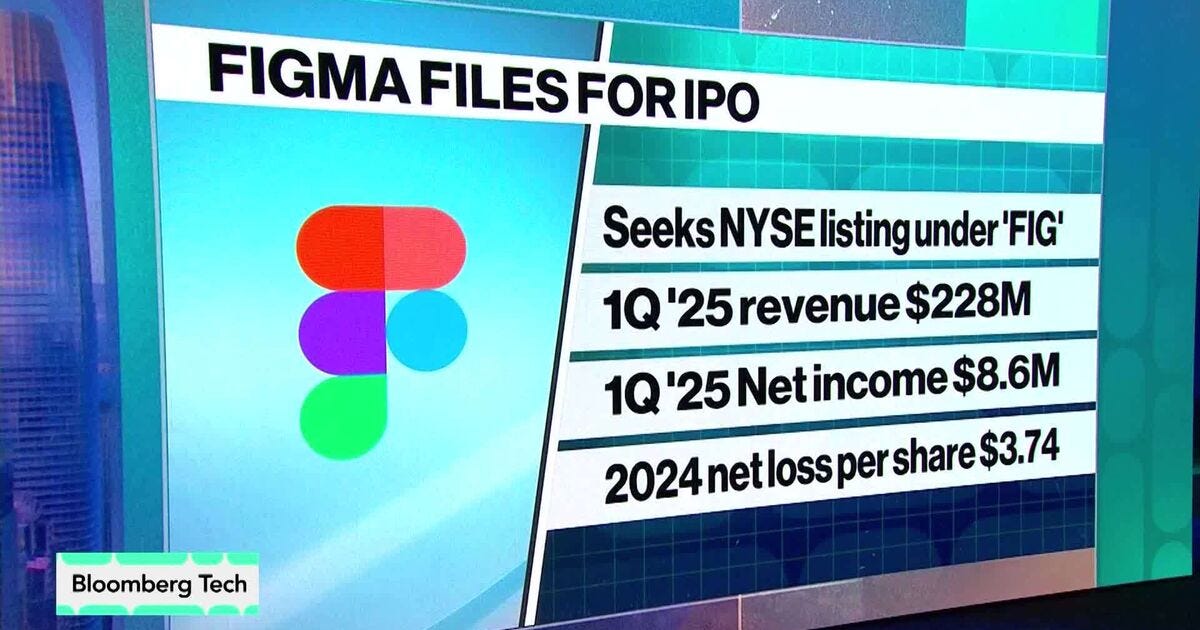

Figma Tests the IPO Waters

Figma's S-1 filing dropped this week, and it's worth examining what it reveals about both the design collaboration space and today's highly selective IPO market.

After nearly three years of public market hibernation, we're finally seeing signs of life. But companies like Figma are discovering that today's IPO gatekeepers have developed significantly higher standards than their pre-2022 predecessors. The metrics that mattered in the ZIRP era aren't going to cut it anymore.

OnlyCFO shared a great breakdown of Figma’s S-1.

What's particularly interesting is how Figma's competitive positioning against Adobe, AI-native startups, and the broader design tooling ecosystem will evolve under the scrutiny of quarterly earnings calls.

While I'm not deep enough in the design collaboration trenches to handicap this specific battle, some Figma metrics jumped out to me:

132% Net Revenue Retention (NRR) as of Q1 2025.

Note: Figma is excluding full customer churn from NRR, which is very sneaky, but given their high GRR (in $10K+ customers), it wouldn’t change NRR all that much (4% reduction in NRR)

91% Gross Margin (best-in-class)

28% LTM Free Cash Flow margin

Figma Rule of 40: 74 (46% growth + 28% FCF margin). This is the second-highest Rule of 40 Score for all public cloud companies. First place is Palantir with a score of 76, but they trade at 80x (!) NTM revenue

Companies going public now need not just solid growth and unit economics, but defensible competitive moats that can withstand both market volatility and well-capitalized incumbents.

As a SaaS market participant, I'm watching this one closely. If Figma can successfully navigate the public markets, it could signal that the IPO window is genuinely reopening for high-quality SaaS companies—emphasis on "high-quality."

The days of growth-at-all-costs IPOs are over, and Figma might just be showing us what the new playbook looks like.

Cutting Through the AI Clutter

This week's listen: Elad Gil and Sarah Guo finally see some clarity emerging from the AI chaos. After months of frantic experimentation across every industry, early winners are crystallizing in three domains with undeniable AI traction: medical scribing, customer support, and coding agents.

The most successful companies aren’t winning because they automate more efficiently.

They’re winning because they’ve rendered traditional workflows irrelevant, replaced by entirely new systems that only AI makes viable.

What's equally revealing is the contrast with use cases still flailing around for product-market fit. Sales automation, financial analysis, accounting, and pharma remain stubbornly resistant to AI disruption, despite massive investment and hype.

The pattern exposes just how specific—and rare—the conditions need to be for AI-native solutions to actually deliver on their promises rather than just burn through venture capital.

The conversation also touches on what's coming next: a wave of consolidation and M&A as the market matures and reality sets in. The back half of 2025 could unleash an IPO and M&A bonanza that makes 2021 look calm.

The Stock Market Always Wins

This is one of the best videos I’ve ever seen explaining markets and traders. Admittedly, Art of the Problem is one of my favorite YouTube channels, so I’m biased.

Video notes:

The market is an information-processing machine

The video opens by demystifying how modern financial markets function as a massive, distributed intelligence system. Through arbitrage (buying undervalued assets and selling overpriced ones), market prices are continuously refined. Added participants like high-frequency traders, quants, and institutional investors ensure smaller inefficiencies are swiftly eliminated. This manifests as a pricing system that becomes increasingly “correct,” even if noisy in the short term.Buffett’s $1M bet

The centerpiece is Warren Buffett’s iconic $1 million bet (placed in 2008), challenging hedge funds to outperform a simple S&P 500 index fund over a decade. Predictably, the low-cost Vanguard S&P 500 fund triumphed. This wasn’t a fluke. It exposed how active management often fails to overcome fees, turnover, and the systematic edge held by market pros. The bet definitively proved that most investors are better off buying broad-market index funds.Implications for amateurs and quants

A striking takeaway: aspiring individual investors or day traders/quants are swimming upstream. These folks face banks and hedge funds with superior math, faster systems, and better data. The video underlines that amateur attempts to beat the market rarely succeed, and every failed arbitrage just contributes to market efficiency, helping index-fund investors indirectly.Elegance in simplicity

The video ends on a subtle but powerful note: passive investing isn’t boring, it’s brilliant. It turns out the smartest move is to quietly ride the wave created by high-speed traders, hedge funds, and institutions. Index investors may look hands-off, but they’re participating in one of the most sophisticated systems humans have ever built.

The index fund is one of the most powerful yet underappreciated financial innovations of the last century. Thank you, Jack Bogle.

That’s all for this week. We’ll be back in your inbox next Sunday with another Margin of Signal.

Thanks for reading,

Chima