Product-Led Growth, Meta's Capital Allocation Strategy, and OpenAI Hardware

Issue #3 | Margin of Signal: June 22, 2025

A weekly curation of the highest-signal content across investing, business, tech, and AI.

This week, we explore:

Product-led growth (and Atlassian’s rise to a $50 billion public company)

First principles thinking

Why Elad Gil believes AI is dramatically under-hyped

Meta’s capital allocation strategy

Q1 2025 cloud software earnings trends

Andrej Karpathy’s AI startup school keynote

The future of OpenAI

Jay Simons (Former Atlassian President) - The $50B PLG Blueprint

Jay Simons (General Partner at BOND; former President of Atlassian; board member of HubSpot and Zapier) breaks down how Atlassian turned developer tools into a self-service growth machine that redefined enterprise software.

This 2023 conversation was a masterclass in building a generational software company through unconventional means.

The episode digs into the core philosophies that powered Atlassian from a bootstrapped Australian startup into a $50 billion public company, and how those lessons now inform Simons' work as a venture capitalist.

Packed with timeless insights on PLG strategy, bottom-up adoption, and building products that sell themselves.

Essential listening for software operators, founders, investors, and anyone curious about how the best B2B companies scale.

Key Insight #1: True Product-Led Growth (PLG) is about designing a business model where the customer feels they are winning.

The central theme of Atlassian's success is its pioneering approach to PLG. However, Simons clarifies this wasn't merely a marketing tactic; it was the entire business model.

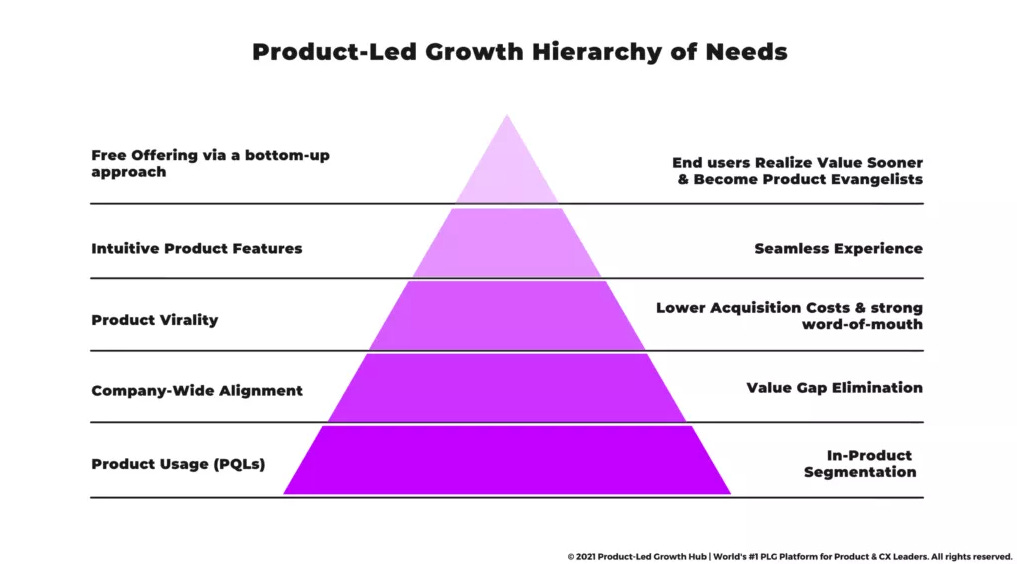

PLG is a business strategy where the product itself is the primary driver of user acquisition, activation, and retention. Unlike traditional sales-led models, PLG emphasizes intuitive and delightful user experiences that empower users to discover and unlock value on their own.

Atlassian's strategy wasn't just about offering a free trial.

It was about systematically removing friction and pricing the product so affordably that it became an irresistible deal.

Atlassian priced its products, like Jira and Confluence, just below the $10,000 threshold that typically requires formal purchase requisitions in large companies. This allowed any developer or team manager to simply swipe a credit card and get started, eliminating the friction of a traditional sales cycle.

The customer was meant to feel like they were getting a "ridiculously cheap" deal, which lubricated adoption and expansion.

“You want customers that begin with the product and be like I can't believe I'm only spending this amount of money on the product that does this for me. They're going to look at what they get and how much they spent and feel like, man, I'm getting the better end of the deal.”

- Jay Simons

Atlassian intentionally optimized for massive market share first and monetization later.

This combination of pricing strategy and affordability effectively became one of their moats.

Key Insight #2: A culture of "first principles" thinking is the foundation for genuine innovation. Because Atlassian's founders had never worked at another company, they weren't bound by conventional wisdom.

They relentlessly questioned the "why" behind every established business practice, from sales compensation to marketing tactics.

This forced the team to invent new playbooks rather than copy existing ones, leading to a uniquely resilient and efficient business model born out of curiosity and capital constraints.

“You couldn't say we should do it this way because this is the way it was done at my last company...they would say, 'Well, why? Why did they choose to do it that way?' And I think what they were rooting out was if everybody was just choosing a certain way to do things because they'd just seen somebody else do it.”

This first principles thinking extended to Atlassian’s community and customers.

Atlassian intentionally fostered its user community by identifying and funding champions to run local user groups, providing pizza and beer, and turning these meetups into a coordinated channel for product launches and feedback.

💡 Takeaways:

Instead of asking "How much can we charge?" reframe the question to "How can we make our product so valuable at this price that adoption becomes frictionless and viral?"

Define success on your own terms. Chasing competitors' growth tactics can pull you into an unsustainable business model that sacrifices long-term durability for short-term optics.

🎯 Closing thought: Atlassian’s multi-billion-dollar success wasn’t built on conventional Silicon Valley growth hacks, but on a disciplined, counter-intuitive strategy that prioritized ubiquity over revenue growth, long-term compounding over short-term velocity, and a deep-seated culture of questioning everything.

Elad Gil - Silicon Valley's Secret Weapon

Meet the best investor you've never heard of.

He backed Airbnb, Stripe, Coinbase, and Pinterest before they became household names.

Elad Gil is Silicon Valley's most successful stealth operator. In this rare deep dive, he reveals his contrarian approach to spotting billion-dollar startups, why he prioritizes market opportunities over founders, and his bold predictions for the AI landscape.

While Atlassian mastered bottom-up adoption in the pre-AI era, Elad is spotting the next wave of product-led disruption.

From Farnam Street:

Elad decodes why innovation has clustered geographically throughout history, from Renaissance Florence to Silicon Valley, where today 25% of global tech wealth is created. We get into why he believes AI is dramatically under-hyped and still under-appreciated, why remote work hampers innovation, and the self-inflicted wounds that he’s seen kill most startups.

This is a masterclass in pattern recognition from one of tech’s most consistent and accurate forecasters, revealing the counterintuitive principles behind identifying world-changing ideas.

Disclaimer: This episode was recorded in January. The pace of AI development is staggering, and some of what we discussed has already evolved. But the mental models Elad shares about strategy, judgment, and high-agency thinking are timeless and will remain relevant for years to come.

Susan Li (Meta CFO) - Inside the $100B Decision Room

The youngest Fortune 100 CFO makes her podcast debut to reveal the strategy behind Meta's billion-dollar bets.

Susan Li—the wunderkind who started high school at age 11 and now steers Meta's financial strategy—goes on Stripe’s new podcast to pull back the curtain on capital allocation at unprecedented scale.

From massive GPU clusters to Reality Labs, she breaks down the financial strategy behind Meta's industry-reshaping bets.

This is your rare window into how one of the world's most powerful companies deploys capital.

Clouded Judgement - Q1 2025 Public Cloud Earnings Deep Dive

The most comprehensive breakdown of public cloud earnings you'll read this quarter.

Jamin Ball's Clouded Judgement analysis dissects Q1 2025 results across hyperscalers (AWS, Azure, Google Cloud) and the entire public cloud ecosystem.

Some of the main themes:

1. Exceptional Outperformance by Top Cloud Companies

The top decile of public cloud software companies beat earnings estimates by over 4%, guided ahead of consensus (+2%), grew >27% YoY, and delivered 84%+ gross margins with >40% free cash flow

Net revenue retention exceeded 119%, with CAC payback under 23 months, signaling robust growth and capital efficiency.

2. Divergence Within the Sector

The top decile is right-skewing results, while the broader market is under pressure. This suggests a growing gap between winners and the rest.

As always, power laws rule everything around us.

3. The Playbook for Enterprise Cloud Winners

Excel on four metrics:

Revenue growth (27%+ YoY)

Margins (84%+ gross, 40%+ FCF)

Retention (Net Revenue Retention >119%)

Efficiency (CAC payback <2 years)

💡 Key takeaway: A select few public cloud leaders continue to beat across growth, margins, retention, and efficiency, validating a refined playbook for long-term success and signaling a widening chasm between winners and the rest.

Clouded Judgement made a great callout re: net revenue retention (NRR).

“High net revenue retention is the fourth aspect of a successful quarter, and one of my favorite metrics to evaluate in private SaaS companies. It is calculated by taking the annual recurring revenue of a cohort of customers from 1 year ago, and comparing it to the current annual recurring revenue of that same set of customers (even if you experienced churn).”

My take: as competition between SaaS incumbents and AI-native upstarts intensifies, NRR is becoming one of the most important metrics to monitor.

It’s a proxy for product stickiness, expansion velocity, and long-term defensibility—a signal of whether customers are merely staying or actively growing with you.

“The reason I love this metric is because it really demonstrates how much customers love your product. A high net revenue retention implies that your customers are expanding the usage of your product (adding more seats / users / volume - upsells) or buying other products that you offer (cross-sells), at a higher rate than they are reducing spend (churn).”

Andrej Karpathy - The Future of Software is Here

Andrej Karpathy (Tesla AI legend and OpenAI co-founder) just dropped his AI Startup School keynote.

Stop what you’re doing and give it a watch.

Karpathy (now founder of Eureka Labs) delivers his vision of "Software 3.0,” where LLMs become the new computer and programming happens in plain English.

Software is going through a fundamental shift.

Software 1.0: Write code by hand

Software 2.0: Train neural networks

Software 3.0: Talk to computers in English

Everyone who speaks English is now a developer.

Goodbye 5-10 year learning curve, hello vibe coding.

What about AI agents?

While the competition still thinks in "technical vs non-technical" users, the smart money is building for a world where your next big customer might be an AI agent.

This is 39 minutes of must-see TV for anyone building in the AI era.

Sam Altman & Jack Altman - The OpenAI Master Plan

The Altman brothers reveal OpenAI's long-term vision across consumer, B2B, and hardware.

Sam Altman sits down with his brother Jack to discuss OpenAI's long-term strategy beyond ChatGPT—including their thoughts on AI-native devices and the optimal form factor for the next computing paradigm.

IMO, OpenAI’s consumer hardware play is the most intriguing topic, as it signals the next platform war.

This was an interesting view inside the mind of the CEO steering the most important company in AI.

As an aside, it’s worth noting that Stripe and OpenAI both launched podcasts this week.

Tech companies realized something: owning the conversation is as important as owning the code.

In the attention economy, content is how you capture mindshare and convert it to market share.

anuatluru on X said it well:

Stripe Press was already prescient, but even the best ideas need multi-modal modern distribution, and personalities become all the more powerful in parasocial content formats

Content is eating the world.

That’s it for this week. We’ll be back in your inbox next Sunday with another Margin of Signal.

Thanks for reading,

Chima