Stock market bubbles don't grow out of thin air. They have a solid basis in reality, but reality as distorted by a misconception.

When I see a bubble forming, I rush in to buy, adding fuel to the fire. That is not irrational.

- George Soros

It’s early March 2024. The stock market has already hit record highs multiple times this year.

I’m using this platform to jot down my current thoughts and observations—the exercise helps me with thinking through things in the moment, as well as post-mortem learnings.

Market Sentiment

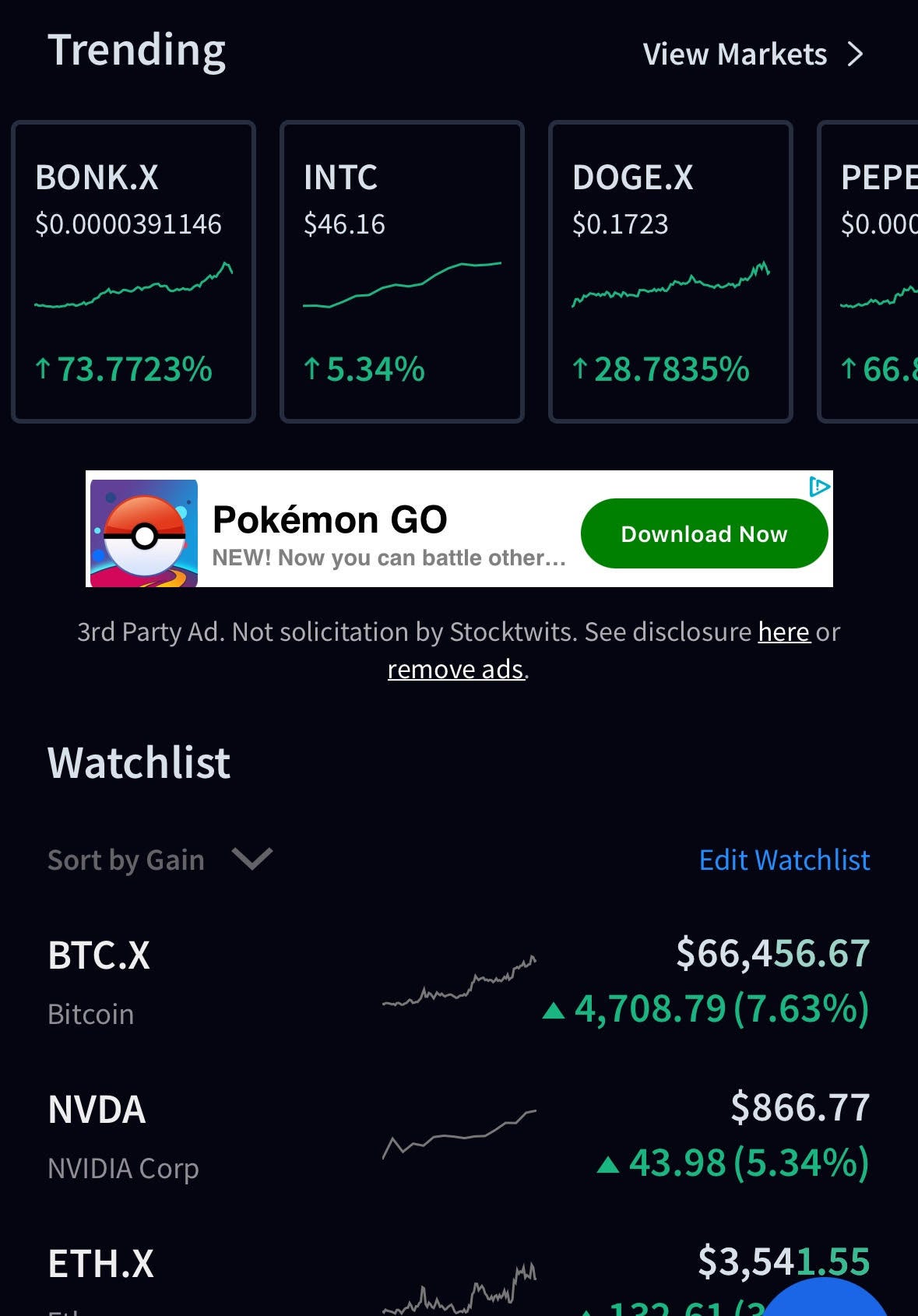

I’ve always found Stocktwits to be a great resource for gauging sentiment—here’s what’s trending as of March 4th:

Stocks are going up. Investors are feeling good. The S&P 500 has now gone up 16 of the last 18 weeks, the longest such streak since 1971.

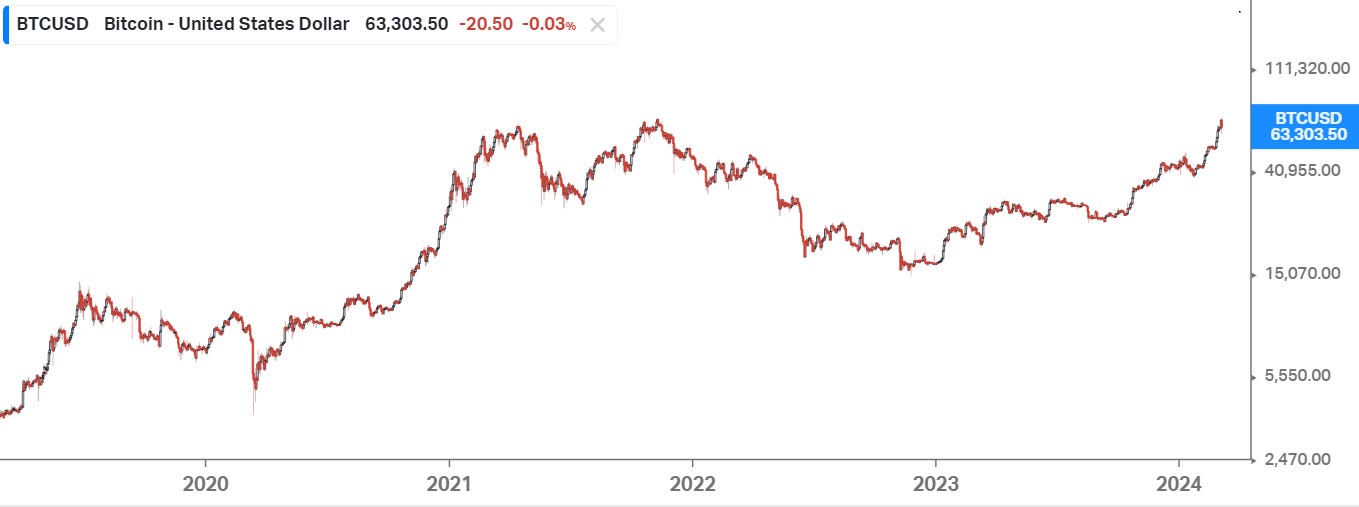

Cryptos and NFTs are skyrocketing. Price action is starting to feel like 2021 all over again.

Nvidia

Is it me, or does it feel like Nvidia is up 5% on the daily? The stock is being mentioned in headlines left and right.

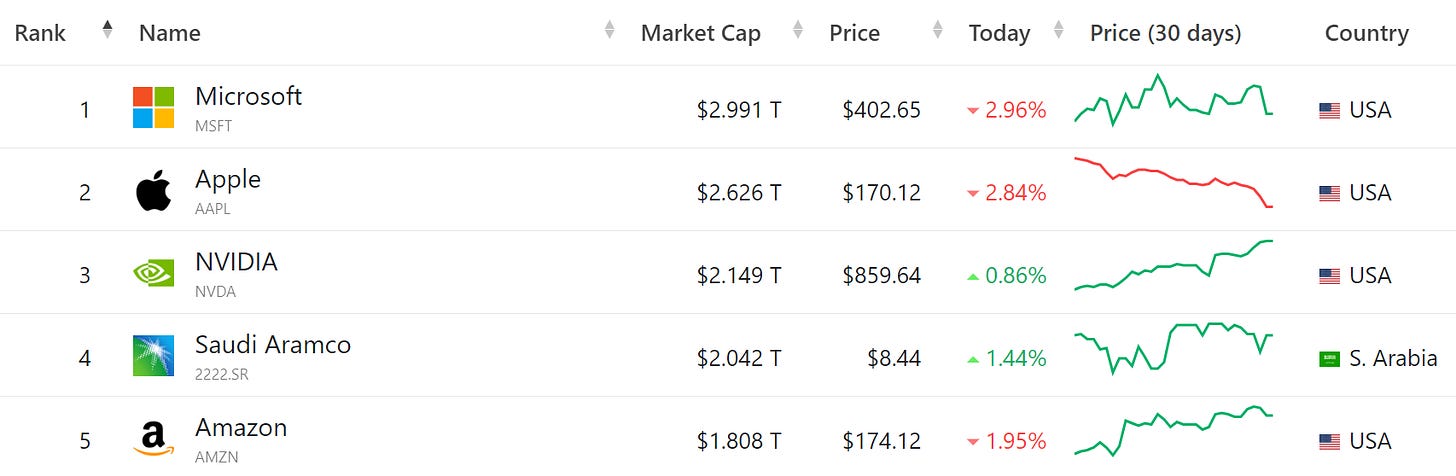

It recently overtook Saudi Aramco as the 3rd most valuable company on earth.

The only logical ending for this bull market is for Nvidia to be crowned #1.

Recent buys

The two main stocks I’ve been buying this year are NVDA 0.00%↑ and NVO 0.00%↑ .

Rationale:

Both companies continue to beat earnings estimates and guide higher

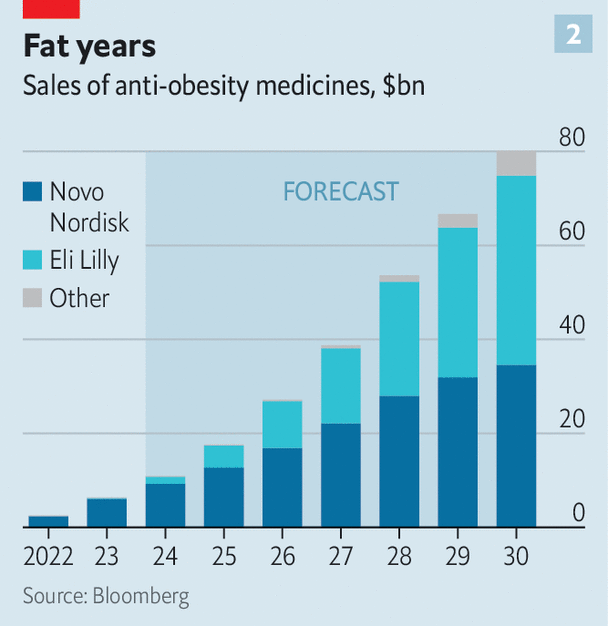

Per The Economist, sales of weight loss drug Wegovy, developed by Novo Nordisk NVO 0.00%↑ , swelled from $876 million in 2022 to $4.5 billion in 2023. The company expects to double that this year

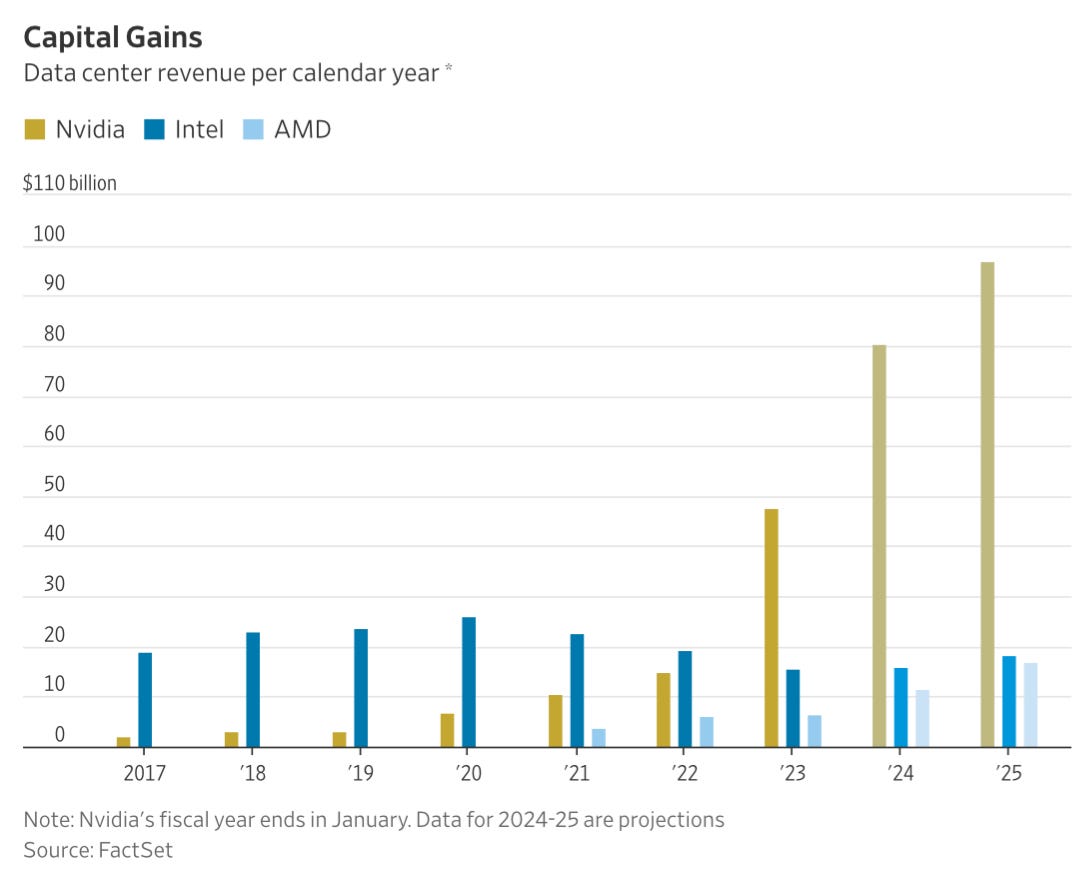

Nvidia’s revenue for the fiscal fourth quarter ended January and its revenue forecast for the current quarter both beat Wall Street’s consensus estimates by 10%. Revenue for the data center segment (which includes the chips designed for generative AI computing) hit $18.4 billion—5x its level from a year ago. Management expects data center revenue to continue growing sequentially in the April quarter, when it expects total revenue to have tripled from the same period last year.

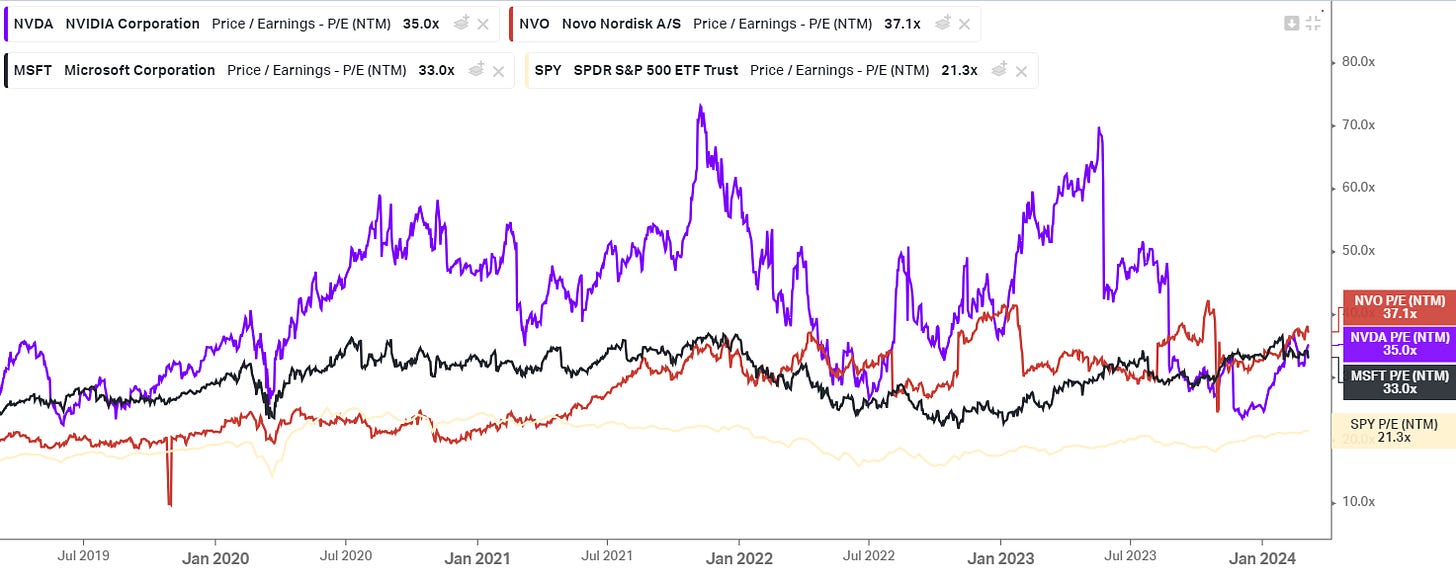

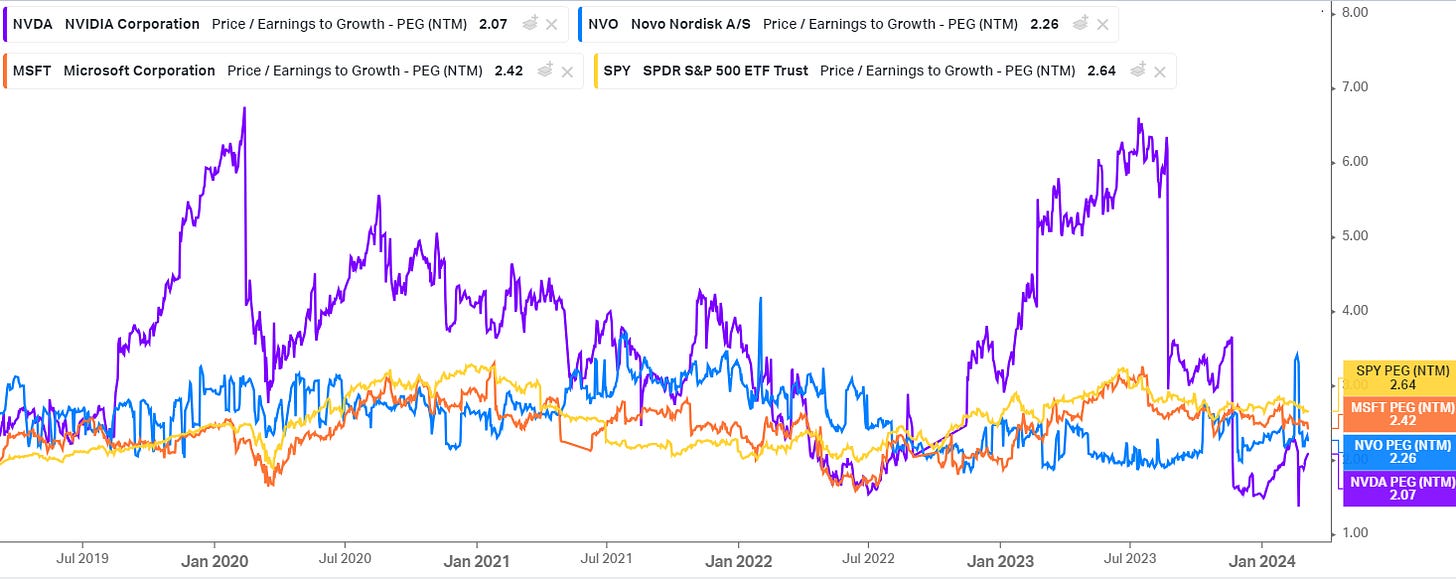

Based on consensus estimates, they aren’t as expensive as I originally thought. A week before its most recent earnings call on 2/21, Nvidia was trading at 34 times projected earnings for this year, which is 18% below the stock’s three-year average

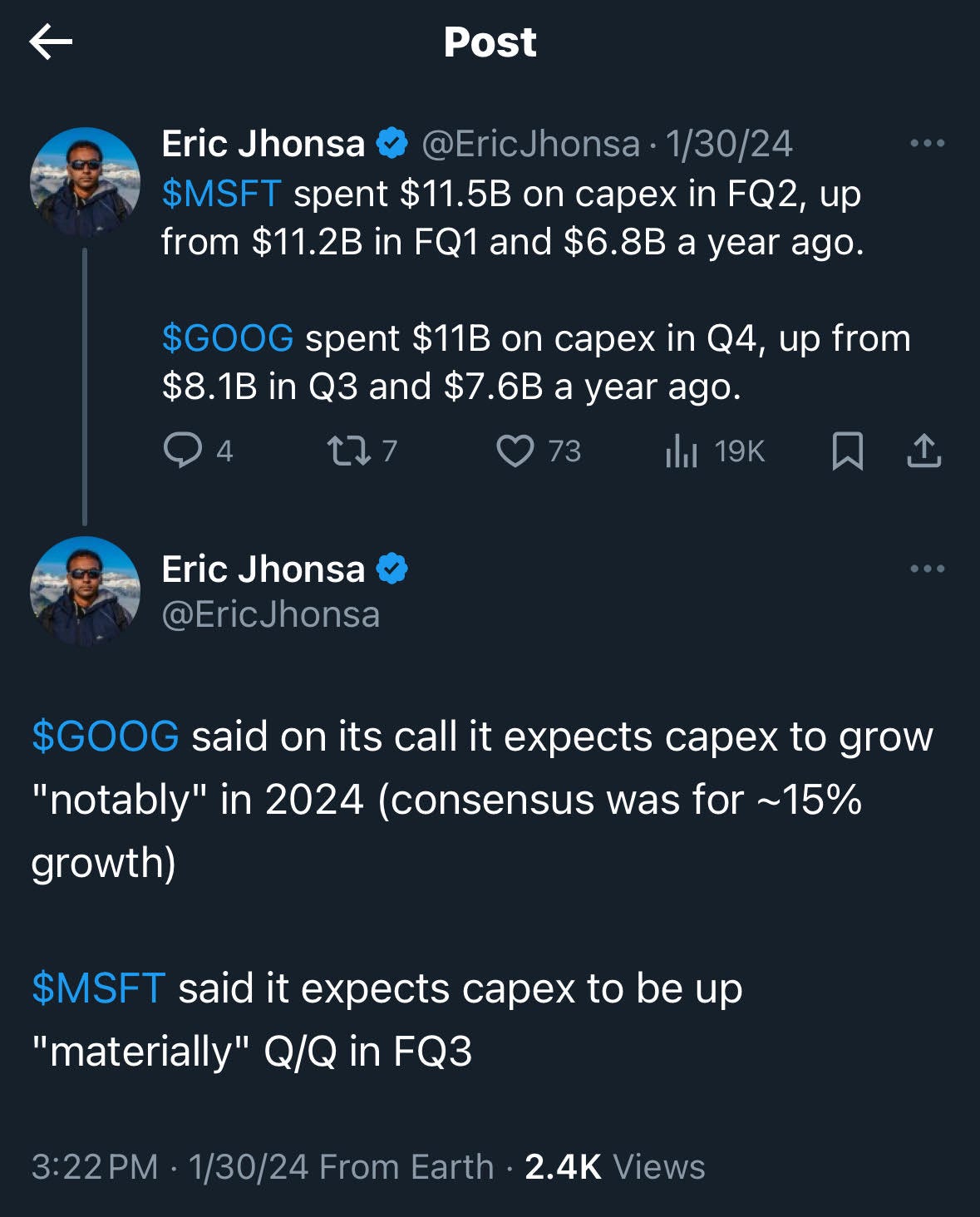

Both companies face the enviable dilemma of product demand outpacing supply for the foreseeable future. Per the WSJ, Microsoft, Amazon, Alphabet, and Meta all told investors during their most recent earnings calls that they plan to boost capital spending this year for the type of AI components that Nvidia provides. Nvidia CFO Colette Kress said “demand far exceeds supply” for the company’s current chips, and that next-generation products are also expected to be “supply constrained.”

Long story short, I’m (responsibly) leaning into the bubble

Maybe it is that simple?

When Bitcoin $100k…?